Jurassic Releases 2025 B2B SaaS Benchmarks Report

Jurassic tracks leading Industry Benchmarks and Reports to provide median and best in class metrics and trends across SaaS profiles. We’ve been tracking this data for over a decade from our operating days and have found it to be a major value-add for those we’ve shared with. However, aggregating these various sources and providing timely context around what’s most relevant for our portfolio companies going through the $2M to $20M journey proved difficult given the noise. So, we chose to curate down to what was most relevant for them and the immediate size profiles near theirs. We hope you’ll find it useful for your company.

We’re excited to launch year three with this report, covering 2024 and through the first half of 2025 in most cases. Here’s what you can expect to see this year:

1. Operating Metrics trends vs. past years

2. Quartiles for the $5-20M ARR companies, highlighting the ranges for each metric and showing best-in-class 75th percentile

3. Market Update, featuring Fundraising, M&A, People, and AI trends through Q2 2025

4. Interactive Board Scorecard tool to help track many of these metrics on a quarterly basis, comparing against past trends and market benchmarks

Get the 2025 Jurassic B2B SaaS Benchmarks Report!

Here are a few of our favorite highlights from the report:

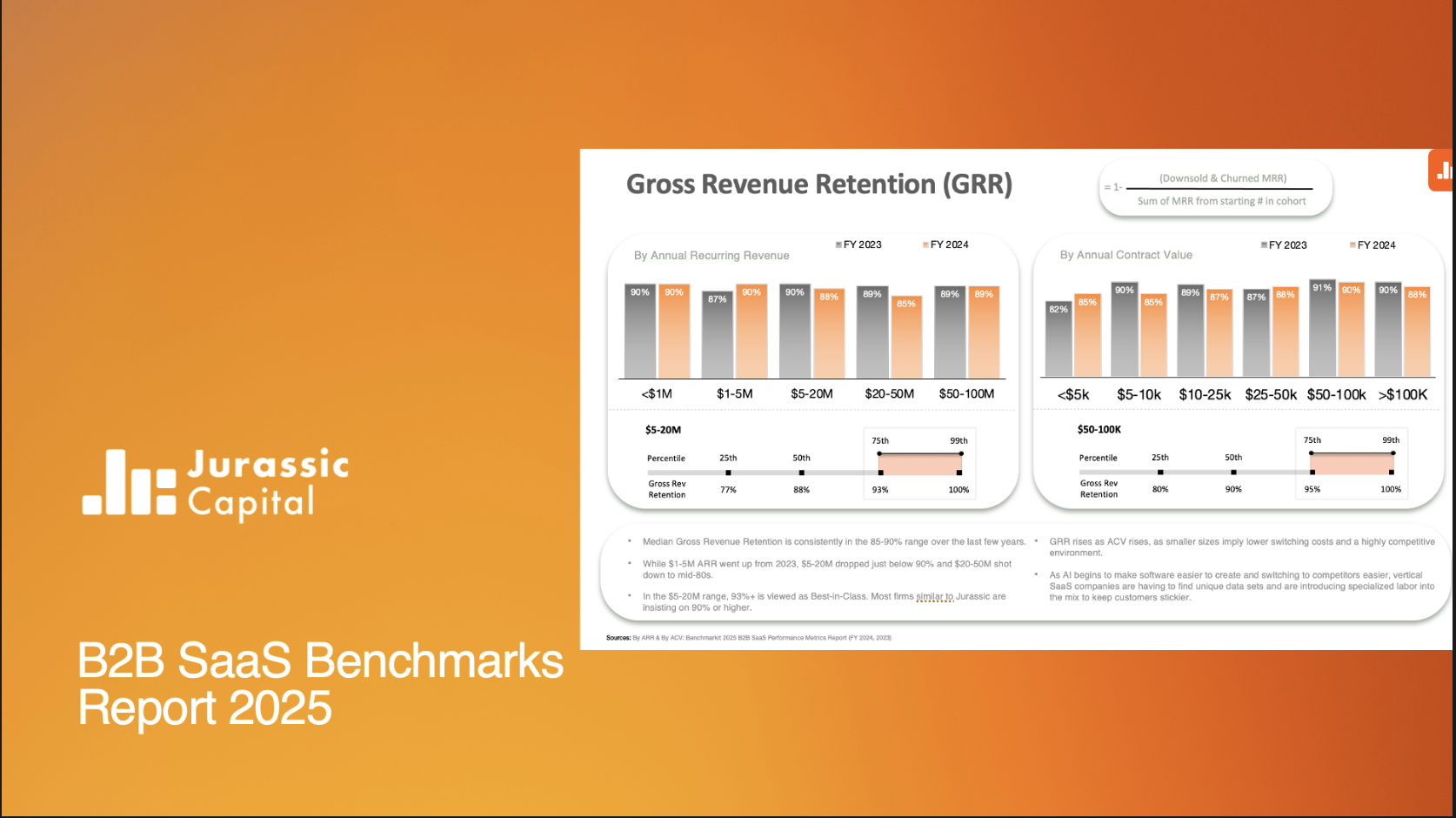

1. Retention Under Pressure

Gross Revenue Retention (GRR) dropped to 88% median for $5-20M ARR companies (down from 90%), with logo retention falling to 86%

Net Revenue Retention (NRR) declined to 101% showing expansion is becoming increasingly challenging

AI is making switching easier, forcing vertical SaaS to rely on unique datasets and specialized labor for stickiness

2. Growth vs. Efficiency Trade-offs

ARR Growth continues declining for 4th consecutive year - $5-20M companies at 27%

Burn Multiples are stable at 1.5x while gross margins improved to 77% as companies focus on capital efficiency

3. Sales Getting Tougher

Expansion ARR now 37% of total new ARR as new logo acquisition becomes harder

Sales cycles finally dropped 9% YoY in early 2025 after years of increases, showing some market softening and hopefully leading to growth later in 2025

4. Lean Operations

Teams are doing more with less: Series A companies down to 15 people (from 20 in 2023)

Hiring at historic lows with dramatic reduction in 2024 software hiring, likely due to AI improving efficiency in OpEx

OpEx % of Revenue is dropping for companies utilizing AI (with some re-deploying into Growth via Sales & Mktg), while COGS are increasing due to compute costs

Founder salaries plateau around $140k median after $5M revenue

5. Market Recovery driven by AI, but cautious road ahead for equity-backed companies, driven by barbell effect

Growth/PE dry powder and re-opening of IPO window drove best first half for software M&A ever in quantity with median multiples slowly rising to 4.2x

Concentrated LP fundraising into fewer firms leading to fewer rounds at higher valuations: Seed/Series A up 30%/2% in valuations but down 48%/60% in volume

Seed and Series A companies are still ~2 years to graduate to the next round; Bridge rounds increased to record highs as Seed/Series A at 46%/36% of all rounds

AI companies command 41% valuation premium over those that aren’t defined as AI

Onward!

Kevin, Joe, and Adam