Jurassic Releases 2024 B2B SaaS Benchmarks Report

Jurassic tracks leading Industry Benchmarks and Reports to provide median and best in class metrics and trends across SaaS profiles. We’ve been tracking this data for over a decade from our operating days and have found it to be a major value-add for those we’ve shared with. However, aggregating these various sources and providing timely context around what’s most relevant for our portfolio companies going through the $1M to $10M journey proved difficult given the noise. So, we chose to curate down to what was most relevant for them and the immediate size profiles near theirs. We hope you’ll find it useful for your company.

After releasing our inaugural report last fall, we’re excited to launch year two with this report, covering 2023 and into 2024 in many cases. Four things you can expect to see this year:

1. Operating Metrics trends vs. past years and best-in-class guidance

2. Fundraising environment trends through Q2 2024; NEW THIS YEAR

3. M&A environment trends through Q2 2024; NEW THIS YEAR

4. AI Metrics; NEW THIS YEAR

Jurassic Capital 2024 B2B SaaS Benchmarks Report

Here are a few of our favorite highlights from the report:

Growth, Retention, and Financials:

For $1-20M ARR companies, median ARR Growth Rates dropped as expected from 2022 to 2023 and have stayed at roughly the same rate in 2024 YTD.

$1-5M: 40% to 32%

$5-20M: 32% to 28%

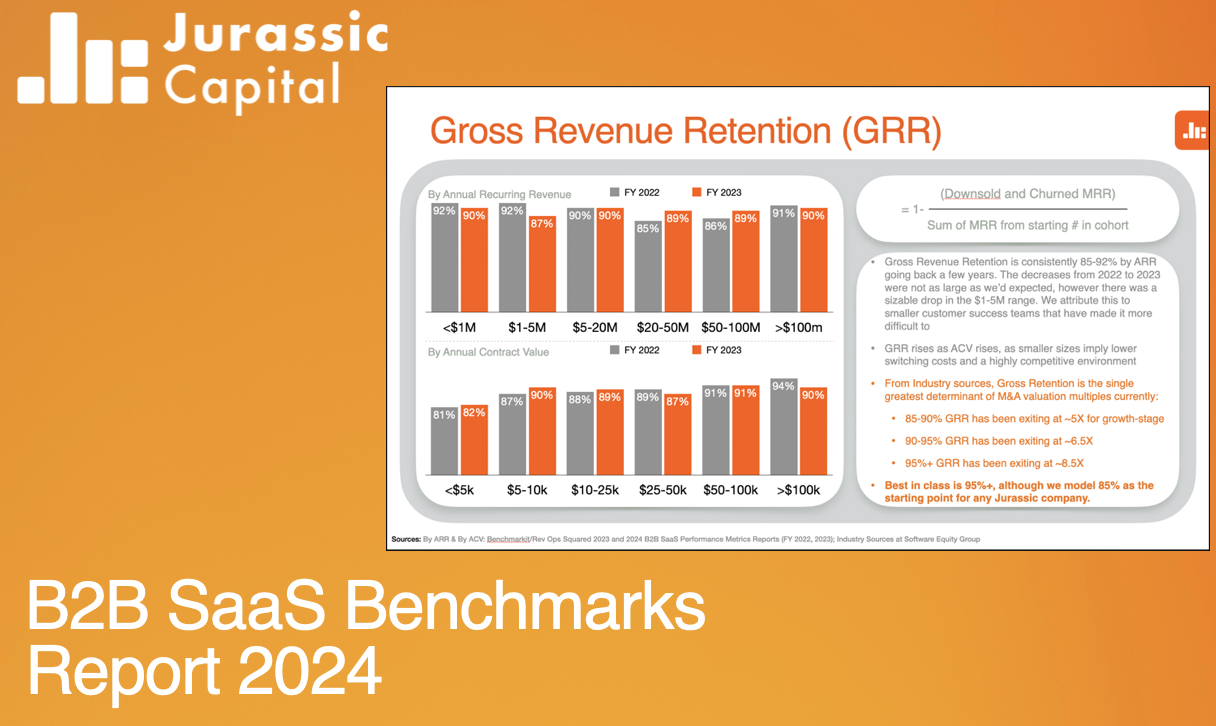

From Industry sources, Gross Retention is the single greatest determinant of M&A valuation multiples currently:

85-90% GRR have been exiting at ~5X for growth-stage SaaS companies

90-95% GRR have been exiting at ~6.5X

95%+ GRR have been exiting at ~8.5X

Median Gross Retention dropped for $1-5M companies from 92% to 87%, while $5-20M stayed roughly the same at 90%.

The shift to capital efficiency given the difficult fundraising environment meant cost cuts so median EBITDA for $3-20M Equity-backed companies went from (25%) in 2022 to (10%) in 2023.

Fundraising and M&A

•The SaaS early stage fundraising environment is still challenging, but showing slight signs of improvement. The Time Between Stages for Seed to Series A has increased from 18 months in 2019 to 25 months as of Q2 2024.

• Down rounds (24% of all rounds) and Bridge Rounds (41% of all Seed stage companies, 42% of Series A companies) peaked in Q1 ’24 but are both trending down as of Q2 ’24.

• Step-up multiples between stages seem to have bottomed out in 2023 and are on the rise again.

In Q2 2024, M&A multiples saw their first increase QoQ in over two years to a median of 4X.

AI

60% of SaaS companies are leveraging GenAI in their product.

42% of companies who have released GenAI features are not monetizing it.

Onward!

Kevin, Joe, and Chrissy